Military Equipment Etf - A fund that covers both government and private defense contracts and has several major players involved in space exploration, this fund is able to capitalize on all things air and defense and skyrocket funds back portfolio.

Consumer sentiment often affects a company's performance, regardless of its industry. For defense companies, which often deal heavily with governments, consumer sentiment is a less important influence. However, consumer opinions can drive government policy, which can more directly affect a defense company's performance.

Military Equipment Etf

Source: api.army.mil

Source: api.army.mil

The most important factor to consider before investing in defensive ETFs is the general geopolitical conditions around the world. The demand for defense equipment, weapons and military aircraft is strongly influenced by geopolitical setbacks and government responses to tensions.

Risks Of Defense Stocks

These are the top defense stocks ranked by a growth model that scores companies based on a 50/50 weighting of the most recent quarterly year-over-year (YOY) revenue growth and the most recent quarterly earnings per share (EPS

). . Both sales and profits are critical factors in the success of a business. Therefore, the ranking of companies by a single growth metric makes a ranking sarcastic for the accounting anomalies of that quarter (such as changes in tax laws or restructuring costs) that may make some component unrepresentative of the company as a whole.

Companies with quarterly EPS or revenue growth of more than 2,500% were excluded as outliers. Defense stocks tend not to be glamorous like tech stocks, but they provide reliable revenue and earnings from a customer -- the U.S. government -- with a seemingly insatiable appetite for its products.

Defensive stocks tend to be consistent contributors to an income-oriented portfolio, with predictable long-term income streams that translate into consistent dividends. That said, while most defensive stocks are near or at ATHs, BA stock is still down more than 50% from its highs.

Factors To Consider Before Investing In Defense Etfs

Some would say this is a buying opportunity for a top defense company. But investors are reluctant to own Boeing after the 737 landings. The comments, opinions and analysis expressed here are for informational purposes only and should not be considered individual investment advice or recommendations to invest in securities or any investment strategy to

Source: static.seekingalpha.com

Source: static.seekingalpha.com

to take Although we believe that the information provided here is reliable, we do not guarantee its accuracy or completeness. The opinions and strategies described in our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analysis in our content are as of the date of publication and are subject to change without notice.

The material is not intended to be a complete analysis of any material fact regarding any country, region, market, industry, investment or strategy. The history of iShares Dow Jones US Aerospace and Defense ETF on the map is on our website.

The fund manager also has the discretion not to invest more than 20% of the fund's total assets in futures, swaps, cash, options and cash equivalents, which are correlated to the composite index. It exposes investors to the best US aerospace and defense companies.

Fastest-Growing Defense Stocks

The ITA ETF is the largest aerospace and defense ETF, with $2.53 billion in assets under management, with an expense ratio of 0.42%. The top two holdings of this fund take the lion's share of the weight, but its concentration in market leaders in the aerospace and defense sector has traditionally provided significant returns despite concentration risk.

5-year return 43.81%, 3-year return 2.78% and 1-year return 5.82%. This fund provides stability due to the long-term government contracts held by most of its holdings, making it an excellent defensive ETF in today's volatile markets to ensure returns.

The billionaires of the world may race for space, but that is only a small corner of the aviation industry. Aerospace and defense ETFs include stocks that manufacture, distribute and sell aircraft and their related components, producers of military equipment and components, including radar equipment, aircraft and weapons, and all stocks that provide ancillary services to these sectors.

Investors should also pay attention to the strength of the companies holding the defensive ETF track. Businesses must be established and stable, with strong financial health. Apart from company-specific parameters, the expense ratio and average returns of defensive ETFs should also be considered before investing in them.

Source: d1e00ek4ebabms.cloudfront.net

Source: d1e00ek4ebabms.cloudfront.net

Aerospace And Defense Etfs How Do They Work?

The fund says about 35% of its assets are in aerospace and defense companies, with 24% in systems software companies and 10.4% in communications equipment makers. The cost of shares SPDR S&P Kensho Future Security ETF changed up to +0.45% for the week.

Although spending on defense, aircraft and military equipment has declined in recent years, defense ETFs continue to perform well, with high average returns and low expense ratios. Thus, defense ETFs provide investors with diversified exposure to a regulated sector, with low risk and high returns.

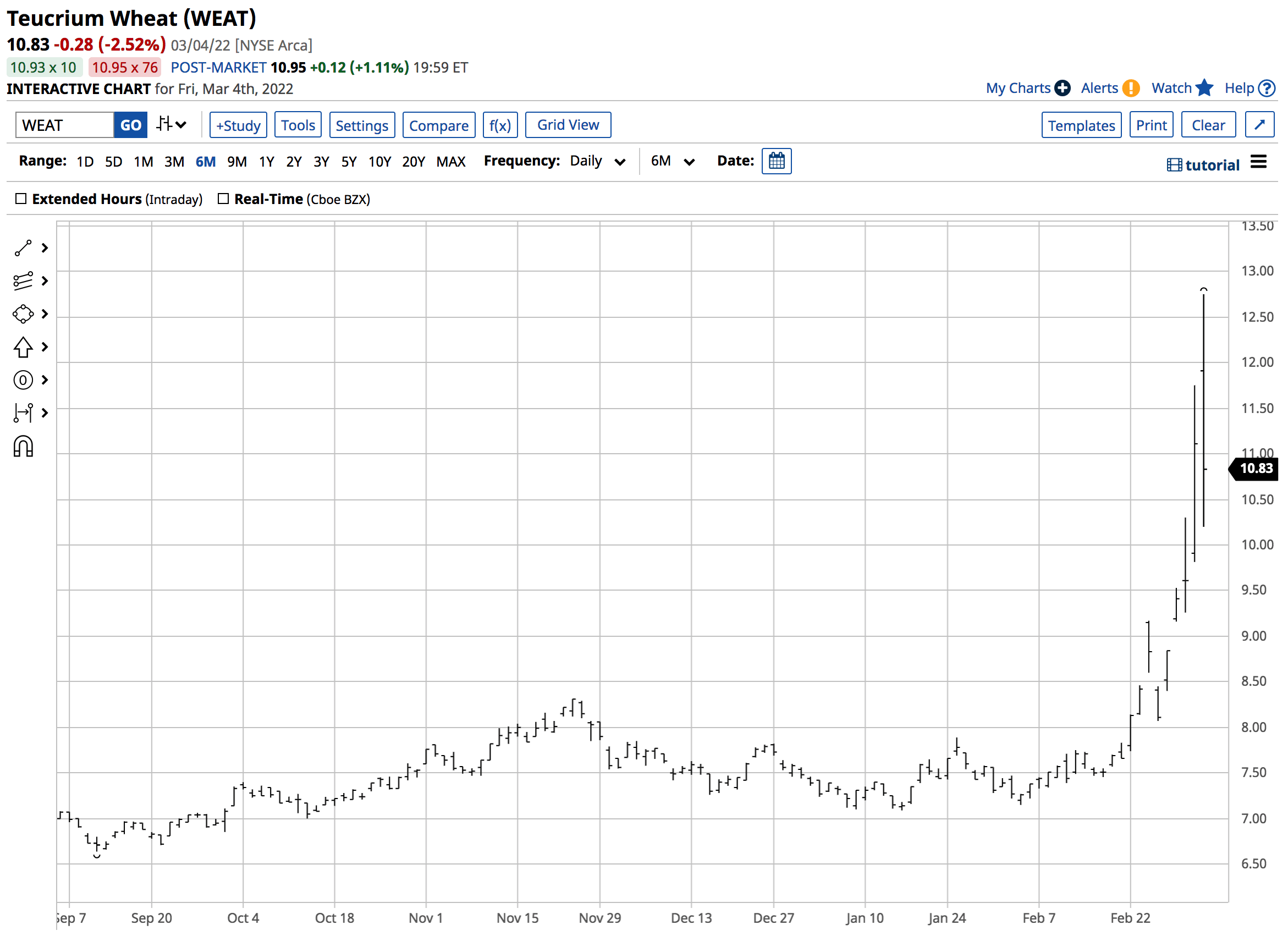

So far, military stocks have outperformed the wartime market as investors look for growth. For example, iShares U.S. Aerospace & Defense ETF (NYSE: ITA ) is up close to 10% since the start of the war.

Additionally, the ETF appears to be breaking out to new ATHs, with industry leaders seeing heavy volume. That said, here are the best military stocks to buy during the war that are leading the charge right now.

Invesco Aerospace Defense Etf

This material may not be published, transmitted, rewritten or distributed. ©2023 FOX News Network, LLC. All rights reserved. Offers appear in real time or with a delay of at least 15 minutes. Market data provided by Factset.

Powered and powered by FactSet Digital Solutions. Legal Notice. Mutual fund and ETF data provided by Refinitiv Lipper. The PPA ETF may be a year older than the ITA, but it has not accumulated as many assets as the latter.

It has $643.9 million in assets under management, with investors walking away with $61 a year for every $10,000 invested. Despite being relatively more expensive than IAT, PPA's weighting is more balanced mitigating against concentration risk and offers broader exposure to the defense and aerospace sectors.

Source: d1-invdn-com.investing.com

Source: d1-invdn-com.investing.com

People have always been fascinated with flight, while countries are always considering how best to protect their borders. In most cases in the modern world, aerospace and defense industries are mentioned in the same breath because of their interdependence.

Spdr Sp Kensho Future Security Etf

While huge spending on defense products is a boon for defense companies, it also creates challenges. Defense companies must speed up production and innovate faster in times of war. The Bain report said defense companies may be left to meet demand, especially given the supply chain problems that are holding back weapons production.

Russia's invasion of Ukraine has been a boon for US defense companies that make missiles, aircraft carriers, bombers, surveillance technology and military satellites. According to some estimates, the war could see European defense spending rise by as much as 65% between 2021 and 2026 to 488 billion euros per year ($519.7 billion).

International arms sales by US companies rose nearly 50% last year to more than $153 billion. They represent a corner of the industrial sector valued at $2.3 trillion in 2021, with an expected CAGR of 7.7% until 2025. In addition to being a trillion dollar market, the aerospace and defense market tends to

thrive in highly volatile markets experiencing correction and recession, making it an ideal defensive option in a post-pandemic environment. This material may not be published, broadcast, rewritten or distributed. ©2023 FOX News Network, LLC. All rights reserved.

Final Thoughts

Offers appear in real time or with a delay of at least 15 minutes. Market data provided by Factset. Powered and powered by FactSet Digital Solutions. Legal Notice. Mutual fund and ETF data provided by Refinitiv Lipper.

Even though Textron saw a decline in revenue due to its line of business, things seem to be back on track. And now, with many countries pledging to increase defenses, Textron could see an additional boost.

Source: www.globalxetfs.com

Source: www.globalxetfs.com

If you think this is a mistake, please contact the Help Desk or use this form. Enter the URL you are visiting, your public IP, and this error code: 0.b558d617.1677927984.f755a8f The Invesco Aerospace & Defense ETF (NYSEMKT: PPA ) is based on the SPADE Defense Index, which is designed to

to identify companies involved in the development, manufacturing, operations, and support of the U.S. defense, homeland security, and aerospace industries. The ETF has about $1.43 billion in assets. But no defense contractor does everything and should buy all the major defense companies to get full exposure to a sector.

Direxion Daily Aerospace Defense Bull X Shares

With that in mind, it may make more sense to invest in defense through an ETF that gives you a small stake in a large number of companies with ties to the aerospace and defense markets.

The SPDR S&P Kensho Future Security ETF (NYSEMKT: FITE ) tracks the S&P Kensho Future Security Index, a modernized version of a defense index. The Kensho Index is designed to track companies focused on topics such as cyber security, advanced border security, military robotics, drones and space technology.

This is a relatively new fund and index, and the fund currently has about $30 million in assets. Defense ETFs are reliable investments that offer high returns over the long term. They track the performance of stocks of large companies with remarkable track records.

As such, they serve as excellent additions to investment portfolios seeking balance and diversification. The Invesco Aerospace & Defense ETF tracks the performance of the SPADE Defense Index, with no expenses or fees. It invests at least 90% of its total assets in the holdings of its composite index.

Best Value Defense Stocks

It exposes investors to stocks of major defense contractors and aerospace big wigs, developing defense operational support systems, including homeland, military and national guard, as well as government and space industry support. Political unrest between Ukraine and Russia and the ever-present tension between North Korea and the US could fuel the rocket under the aerospace and defense market, resulting in an unprecedented rally.

Source: image.cnbcfm.com

Source: image.cnbcfm.com

The above ETFs give a great play to this volatility to drive portfolio fund returns sky high. Direxion Daily Aerospace & Defense Bull 3X Shares (NYSEMKT: DFEN ) aims to generate a 300% return compared to its benchmark, the Dow Jones U.S.

Select Aerospace & Defense Index, every day. The fund does this with leverage, and investors should be aware that, along with the potential for additional reward, leveraged ETFs carry significantly more risk than standard ETFs. Direxion states on its website that leveraged ETFs are best for "aggressive" investors who are "willing to accept significant losses over short periods of time."

https://www.direxion.com/education/leveraged-etfs-faq The fund has approximately $230 million in assets under management. Borders are also opening and the revival of the aviation industry is playing bullish sentiment for the aviation segment. Most of these companies are established blue-chip stocks quite expensive to acquire than individual stocks, and if you think about diversification, an alternative investment option becomes necessary.

Top Aerospace And Defense Etfs To Skyrocket Portfolio Returns

In addition, the defense company produces tanks, ammunition and intelligence solutions for warfare. Although a large portion of General Dynamics' revenue comes from the US, they also have a significant international presence. General Dynamics European Land Systems serves customers in Austria, Germany, Spain and more.

The INTF ETF has $905 million in assets under management, with a relatively low expense ratio of 0.30%, compared to the other funds on this list. This ETF is an indirect and diversified play in the aerospace and defense space as it has significant exposure to aerospace and defense applications in its holdings.

The screening and weighting method of multi-index holdings ensures both value and growth for a portfolio. 5-year return 38.01%, 3-year return 20.25%, 1-year return 8.73% and dividend yield 3.00%. These are the defense stocks with the lowest 12-month price-to-earnings (P/E) ratios.

Because profits can be returned to shareholders in the form of dividends and buybacks, a low P/E ratio indicates that you are paying less for each dollar of profit generated.

The Impact Of War On Defense Stocks

us military etf, best military etf funds, aerospace and defense etf, etf military acronym, aerospace and defense etf list, military arms etf, vanguard aerospace and defense etf, vanguard military etf

0 Comments